Financial Strategies to Help Clear Your Loan Debts Faster

Clearing loans quickly is a financial goal many aspire to achieve, yet it often seems challenging due to the weight of monthly payments, interest rates, and other financial commitments. The longer you take to repay a loan, the more you pay interest, which can strain your finances over time.

However, with the right financial strategies, it is possible to accelerate pikalaina repayment and become debt-free sooner than anticipated. This approach requires careful planning, discipline, and a commitment to managing your finances effectively. This article explores practical financial strategies that can help you clear your loans faster and take control of your financial future.

Make Biweekly Payments Instead of Monthly Payments

One effective strategy to repay your loan faster is to switch from monthly to biweekly payments. Paying half of your monthly loan amount every two weeks makes 26 half-payments or 13 full payments each year instead of 12. This additional payment can significantly reduce the loan’s principal amount, lowering the interest you owe over time.

Round up Your Payments

Another simple yet effective method is to round up your loan payments. For instance, if your monthly payment is $468, consider rounding it up to $500. The additional $32 may not seem like much, but over time, these extra amounts add up and reduce the principal faster. This approach requires minimal adjustment to your budget but can significantly impact the total loan repayment period.

Prioritize High-Interest Loans

When you have multiple loans, it’s wise to prioritize repaying those with the highest interest rates first. High-interest loans, such as credit card debt or certain personal loans, can accumulate interest quickly, increasing the overall cost of the debt. By focusing on these loans first, you minimize the amount of interest you pay over time.

Make Extra Payments Whenever Possible

Making extra payments whenever you have surplus income is a powerful way to reduce your loan balance quickly. This could be from bonuses, tax refunds, side gigs, or any unexpected windfall. Instead of spending this extra money on non-essential items, directing it toward your loan can help you pay it off more rapidly.

However, before making extra payments, check with your lender to ensure there are no penalties for early repayment. If there are no penalties, use these additional funds to make lump-sum payments that will directly reduce your loan’s principal amount.

Refinance Your Loan

Refinancing involves replacing your existing loan with a new one with more favorable terms, such as a lower interest rate or a shorter repayment period. This strategy can significantly reduce the amount of interest you pay over the life of the loan and help you clear the debt faster.

Cut Down on Unnecessary Expenses

Cutting unnecessary expenses is one of the most effective ways to free up extra cash for loan repayment. Review your monthly budget and identify areas where you can reduce spending, such as dining out, subscriptions, or luxury purchases. Redirect the money saved toward your loan payments.

Automate Your Payments

Setting up automatic payments ensures you never miss a payment, which can help you avoid late fees and penalties that increase your loan costs. Some lenders even offer a slight reduction in the interest rate if you enroll in autopay. Automating your payments also helps you stay disciplined and consistent with your repayment plan, ensuring steady progress toward paying off your loan.

Seek Professional Financial Advice

If you are struggling with loan repayment or managing multiple debts, seeking professional financial advice can provide valuable insights and strategies tailored to your situation. Financial advisors can help you create a comprehensive repayment plan, negotiate with lenders for better terms, or explore debt consolidation options.

Clearing loans faster requires a combination of smart strategies, financial discipline, and consistent effort. Becoming debt-free provides financial relief and opens up new opportunities for savings, investments, and achieving long-term financial goals.…

Filing for bankruptcy can be a difficult decision to make, but understanding all the implications can help you make an informed decision. It is essential to weigh the pros and cons of each type of bankruptcy before making a decision. Make sure to speak with a legal professional to understand all of your options. With the right information, you can make the best decision for yourself and your financial future.

Filing for bankruptcy can be a difficult decision to make, but understanding all the implications can help you make an informed decision. It is essential to weigh the pros and cons of each type of bankruptcy before making a decision. Make sure to speak with a legal professional to understand all of your options. With the right information, you can make the best decision for yourself and your financial future.

Estate planning was for individuals with high net worth. However, today the middle class also needs a plan in case something happens to the breadwinner. After all, you don’t have to be super-rich to invest in real estate or the stock market that you can pass to your heirs.

Estate planning was for individuals with high net worth. However, today the middle class also needs a plan in case something happens to the breadwinner. After all, you don’t have to be super-rich to invest in real estate or the stock market that you can pass to your heirs.  When you accumulate substantial wealth and need to transfer it to loved ones or family members upon your death, an estate planning process helps you develop the most tax-efficient approach. The three taxes to consider as you transfer money are gift tax, generation-skipping transfer tax, and gift tax. Since there are limits to how much you can transfer without taxation, a good plan will outline a strategy to minimize the taxes you owe to the state.

When you accumulate substantial wealth and need to transfer it to loved ones or family members upon your death, an estate planning process helps you develop the most tax-efficient approach. The three taxes to consider as you transfer money are gift tax, generation-skipping transfer tax, and gift tax. Since there are limits to how much you can transfer without taxation, a good plan will outline a strategy to minimize the taxes you owe to the state.

It is advisable to choose a company that offers free consultation services. That is because it is through consultation that you can understand how the company helps you. Also, you will get to select the services that suit your needs. Remember that you might not need all the services offered by the credit repair company.

It is advisable to choose a company that offers free consultation services. That is because it is through consultation that you can understand how the company helps you. Also, you will get to select the services that suit your needs. Remember that you might not need all the services offered by the credit repair company. Nowadays, most credit repair service providers offer a guarantee. It is advisable to read the terms and conditions to understand the guarantee offered. Remember that not all guarantees are made equal. Some of the companies are known to allow customers to cancel their services without any reason. Some are known to provide money back if they fail to repair your credit. Therefore, you should consider a money-back guarantee when choosing these companies.

Nowadays, most credit repair service providers offer a guarantee. It is advisable to read the terms and conditions to understand the guarantee offered. Remember that not all guarantees are made equal. Some of the companies are known to allow customers to cancel their services without any reason. Some are known to provide money back if they fail to repair your credit. Therefore, you should consider a money-back guarantee when choosing these companies.

As we have said above, the first step to finding a professional insolvency practitioner should be conducting research. If you are new to the business, this means that you need to gather all the relevant information that will guide you to make the right choice. When you have first-hand knowledge, it will help you to avoid committing expensive errors in your business.

As we have said above, the first step to finding a professional insolvency practitioner should be conducting research. If you are new to the business, this means that you need to gather all the relevant information that will guide you to make the right choice. When you have first-hand knowledge, it will help you to avoid committing expensive errors in your business.

As mentioned earlier, mold thrives in humid conditions. Limiting the level of humidity in your home will thus go a long way to prevent mold from growing and thus save you a lot of money that would go into mold control. To control the humidity levels, you can buy a dehumidifier and run it in your home when necessary. With proper care of the dehumidifier, it can serve you for many seasons. You do not have to keep buying one every year before the onset of summer.

As mentioned earlier, mold thrives in humid conditions. Limiting the level of humidity in your home will thus go a long way to prevent mold from growing and thus save you a lot of money that would go into mold control. To control the humidity levels, you can buy a dehumidifier and run it in your home when necessary. With proper care of the dehumidifier, it can serve you for many seasons. You do not have to keep buying one every year before the onset of summer.

dealing with quick loans. Most lenders will require important information like employment details and social media profile to find out whether you qualify for these loans. It is different when borrowing traditional loans where you have to present a guarantor or other securities that will help you secure the loan. You don’t have to worry if you have a poor credit score.

dealing with quick loans. Most lenders will require important information like employment details and social media profile to find out whether you qualify for these loans. It is different when borrowing traditional loans where you have to present a guarantor or other securities that will help you secure the loan. You don’t have to worry if you have a poor credit score.

When choosing a health insurance plan, you will need to first compare private health funds for free to know about every policy’s out of pocket costs. Unlike the old days, today it is impossible to have an idea that will take care of all your pocket costs. Before getting any coverage, you will be required to take care of some out of pockets costs. This is what is commonly known as deductible in a policy. If for instance a treatment will cost you about $200, and say the policy has a deductible of $50. What this means is that basically, you will need to pay $50 while your health plan takes care of the rest. In the events where the cost of treatment is less than the deductible, you will have to fork the whole bill.

When choosing a health insurance plan, you will need to first compare private health funds for free to know about every policy’s out of pocket costs. Unlike the old days, today it is impossible to have an idea that will take care of all your pocket costs. Before getting any coverage, you will be required to take care of some out of pockets costs. This is what is commonly known as deductible in a policy. If for instance a treatment will cost you about $200, and say the policy has a deductible of $50. What this means is that basically, you will need to pay $50 while your health plan takes care of the rest. In the events where the cost of treatment is less than the deductible, you will have to fork the whole bill.

Why should you pay lower or expensive premiums? Any fleet insurance company factors things like the type of vehicles, the number of cars in your fleet, installed security features, qualifications of your drivers, and expected travel times. Ideally, the essence of doing this is to assess the degree of risk, and the insurance is convinced that you offer lower risk based on these parameters, your premiums will be significantly reduced.

Why should you pay lower or expensive premiums? Any fleet insurance company factors things like the type of vehicles, the number of cars in your fleet, installed security features, qualifications of your drivers, and expected travel times. Ideally, the essence of doing this is to assess the degree of risk, and the insurance is convinced that you offer lower risk based on these parameters, your premiums will be significantly reduced.

One good with student loan consolidation is that it offers everyone equal chance at the start as far as interests are concerned. Student loans consolidation institutions are expected to offer everyone the same federal rates. These rates are normally suggested by Congress every year. You, however, need to understand that some companies may fail to take the suggestions from Congress seriously. Such companies should be avoided and never should you seek any kind of help from them.

One good with student loan consolidation is that it offers everyone equal chance at the start as far as interests are concerned. Student loans consolidation institutions are expected to offer everyone the same federal rates. These rates are normally suggested by Congress every year. You, however, need to understand that some companies may fail to take the suggestions from Congress seriously. Such companies should be avoided and never should you seek any kind of help from them. Some student loans provider will always do anything to ensure that they capture your attention. However, if it happens that you find yourself lost for reason or the other, you will realize how stressful this can be. The best way to avoid being stranded after taking a student loan is to ensure that the company that you choose can provide you with all the answers you may seek from them.…

Some student loans provider will always do anything to ensure that they capture your attention. However, if it happens that you find yourself lost for reason or the other, you will realize how stressful this can be. The best way to avoid being stranded after taking a student loan is to ensure that the company that you choose can provide you with all the answers you may seek from them.…

This is another essential factor that will help you in choosing your private road insurance. It is advisable to know what your insurance covers before you make any decision. Therefore, consider these factors if you want to choose the best private road insurance.…

This is another essential factor that will help you in choosing your private road insurance. It is advisable to know what your insurance covers before you make any decision. Therefore, consider these factors if you want to choose the best private road insurance.…

It is always important to be careful with who you entrust your personal information with. We have had cases of identity fraud that happened when people confidential information has fallen into the wrong hands.

It is always important to be careful with who you entrust your personal information with. We have had cases of identity fraud that happened when people confidential information has fallen into the wrong hands. Once you decide on the lender to use, you will need to get your verification documents in order. Before any financial institution gives you money, they will have to confirm that you are indeed the person you are purporting to be.

Once you decide on the lender to use, you will need to get your verification documents in order. Before any financial institution gives you money, they will have to confirm that you are indeed the person you are purporting to be.

difference between these options is that secured finance requires an asset as collateral for the loan. Since the lender does have this collateral to seize in the event of no payment, they tend to offer more flexible terms and be more likely to provide approval. Unsecured loans tend to be only readily available for long established businesses with a high credit rating.

difference between these options is that secured finance requires an asset as collateral for the loan. Since the lender does have this collateral to seize in the event of no payment, they tend to offer more flexible terms and be more likely to provide approval. Unsecured loans tend to be only readily available for long established businesses with a high credit rating. A down payment or deposit of approximately twenty percent will be needed to secure approval. Offering a deposit is a good way to convey your financial responsibility to potential lenders. Even a small deposit will increase your chances of approval compared to not offering any. However, be sure not to offer to put down too high a deposit and compromise your business capital.

A down payment or deposit of approximately twenty percent will be needed to secure approval. Offering a deposit is a good way to convey your financial responsibility to potential lenders. Even a small deposit will increase your chances of approval compared to not offering any. However, be sure not to offer to put down too high a deposit and compromise your business capital.

Cryptocurrencies like Bitcoin are decentralized currencies that make use of the peer-to-peer technology. This means that all the functions of the currency like verification, processing of transactions, and issuance of money by the network. This decentralization is what makes cryptocurrencies free from government control, and that is why many governments discourage its citizens from participating in cryptocurrencies. The Bitcoins, for instance, are created digitally through a method called mining whereby computers crunch numbers and solve complex algorithms.

Cryptocurrencies like Bitcoin are decentralized currencies that make use of the peer-to-peer technology. This means that all the functions of the currency like verification, processing of transactions, and issuance of money by the network. This decentralization is what makes cryptocurrencies free from government control, and that is why many governments discourage its citizens from participating in cryptocurrencies. The Bitcoins, for instance, are created digitally through a method called mining whereby computers crunch numbers and solve complex algorithms. Everyone regardless of his geographical location can own a bitcoin. With over three billion individuals who have access to the internet, they can turn attention to cryptocurrencies and make a few earnings here and there. Counties that have been sidelined when it comes to other forms of payments like Sudan are free to use the cryptocurrencies. The government interference has been eliminated which makes it enjoyable to trade using this type of cryptocurrency. Watch the benefits on cryptocurrencies on the video below;

Everyone regardless of his geographical location can own a bitcoin. With over three billion individuals who have access to the internet, they can turn attention to cryptocurrencies and make a few earnings here and there. Counties that have been sidelined when it comes to other forms of payments like Sudan are free to use the cryptocurrencies. The government interference has been eliminated which makes it enjoyable to trade using this type of cryptocurrency. Watch the benefits on cryptocurrencies on the video below;

You do not have to stick to a schedule that has been put in place by people who probably did not have you in mind. With modern investment options, you should be putting your money where you have more control. Things have shifted from the era when these companies dictated what you do with your money to the present situation where you are the boss. Therefore, you are sure that you will get a flexible plan depending on your needs. You may want to talk to the companies to find out how many plans they have, and pick the one that you can identify with based on the money that you want to invest.

You do not have to stick to a schedule that has been put in place by people who probably did not have you in mind. With modern investment options, you should be putting your money where you have more control. Things have shifted from the era when these companies dictated what you do with your money to the present situation where you are the boss. Therefore, you are sure that you will get a flexible plan depending on your needs. You may want to talk to the companies to find out how many plans they have, and pick the one that you can identify with based on the money that you want to invest. Through investments in precious metals, you easily can safeguard your financial future. There are people who use this as the perfect way to plan for retirement. For example, you can start by looking for plans when you are still young. When you earn from your job, you can buy the metals and keep them safely with the dealers. This way, you can be sure that when you retire, you can easily sell them off, and have your money for use. The best part is that the price of these metals is always growing and therefore, they will be worth a fortune by the time you decide to call it a day on your employment.

Through investments in precious metals, you easily can safeguard your financial future. There are people who use this as the perfect way to plan for retirement. For example, you can start by looking for plans when you are still young. When you earn from your job, you can buy the metals and keep them safely with the dealers. This way, you can be sure that when you retire, you can easily sell them off, and have your money for use. The best part is that the price of these metals is always growing and therefore, they will be worth a fortune by the time you decide to call it a day on your employment.

If you consider taking a land loan, then there are a lot of benefits you are likely to receive. Just as personal loans, you will receive very low-interest rates if you decide to choose a land loan. This is because the terms of this loan continue for more than ten years. This, therefore, will help the borrower to receive some income from that same land he or she purchased to repay the loan.

If you consider taking a land loan, then there are a lot of benefits you are likely to receive. Just as personal loans, you will receive very low-interest rates if you decide to choose a land loan. This is because the terms of this loan continue for more than ten years. This, therefore, will help the borrower to receive some income from that same land he or she purchased to repay the loan. It is essential to know that land is always a good investment. If you decide to take a land loan, you will easily realize it. If you purchase a land, you will get a lot of income based on what you decide to use for your land. You can decide to build rental houses that can give you an income at the end of each month. Therefore, within few years, you will easily repay your loan and make a profit. These, therefore, are some of the benefits you will receive after taking a loan to purchase a land.…

It is essential to know that land is always a good investment. If you decide to take a land loan, you will easily realize it. If you purchase a land, you will get a lot of income based on what you decide to use for your land. You can decide to build rental houses that can give you an income at the end of each month. Therefore, within few years, you will easily repay your loan and make a profit. These, therefore, are some of the benefits you will receive after taking a loan to purchase a land.…

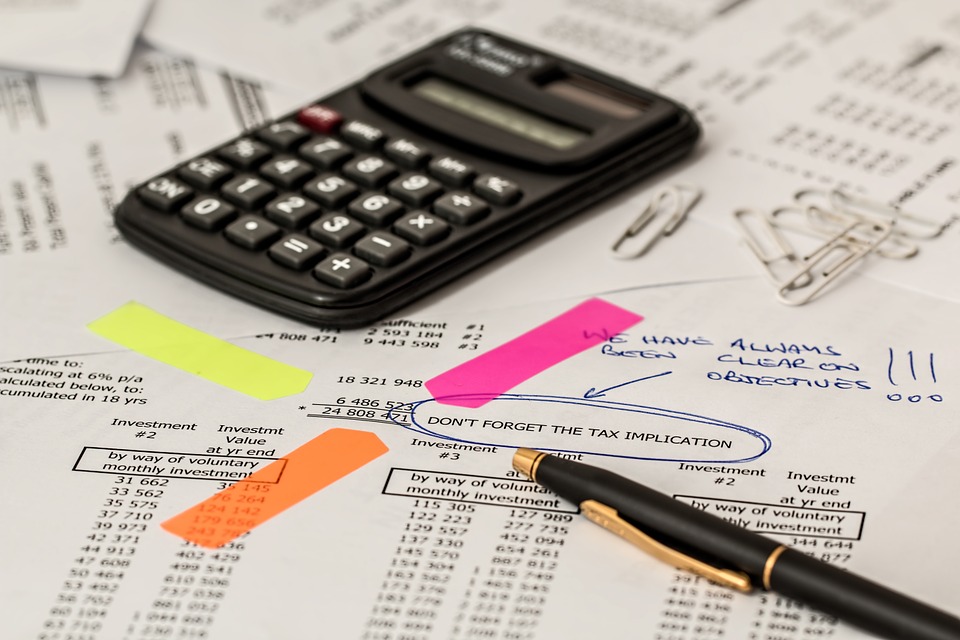

Time is a powerful resource to any business. Successful business always ensures that they employees do not waste even a single minute when it comes to the operation of the business. We all know that accounting is a daunting task that needs to be done with great skills and considerations. This is why most accountants have to cope up with hard calculations to make ends meet. If you are still on paper accounting, then you are off the point. Accounting software is always fast and efficient. If you introduce them in your company, you will create a lot of time for your accountants to do other productive work.

Time is a powerful resource to any business. Successful business always ensures that they employees do not waste even a single minute when it comes to the operation of the business. We all know that accounting is a daunting task that needs to be done with great skills and considerations. This is why most accountants have to cope up with hard calculations to make ends meet. If you are still on paper accounting, then you are off the point. Accounting software is always fast and efficient. If you introduce them in your company, you will create a lot of time for your accountants to do other productive work. Can you imagine a situation where you accounting documents disappear for one reason or the other? That will affect your business terribly, and that is something that you do not want to happen to your business. Finding the commendable accounting software is sure of ensuring that your accounting information is protected from all types of dangers. So there is no need of you being worried about the safety of your information where there is reliable technology to take up the task. Amazon Accounting is the best as it has multiple back systems that are all designed to ensure total safety of your data.…

Can you imagine a situation where you accounting documents disappear for one reason or the other? That will affect your business terribly, and that is something that you do not want to happen to your business. Finding the commendable accounting software is sure of ensuring that your accounting information is protected from all types of dangers. So there is no need of you being worried about the safety of your information where there is reliable technology to take up the task. Amazon Accounting is the best as it has multiple back systems that are all designed to ensure total safety of your data.…

An accountant must have accounting background since this is a technical subject. Without the right expertise, then there is no way one will make it past the first errand you assign them. The accounts background is acquired all the way from college or university and then the job experience. It is crucial to ask for educational qualification certificates and letters of recommendation from the previous employers.

An accountant must have accounting background since this is a technical subject. Without the right expertise, then there is no way one will make it past the first errand you assign them. The accounts background is acquired all the way from college or university and then the job experience. It is crucial to ask for educational qualification certificates and letters of recommendation from the previous employers. An accountant who is fast and accurate will never make you late on handling any financial matters. Furthermore, they are there to make sure that the business does not lose money through inaccurate data entry which can jeopardize all the operations. From the previous recommendations, you can tell whether the potential accountant you want to hire is fast and accurate or not. If using a firm, then do an overall research on the firm before engaging any of their accountants.

An accountant who is fast and accurate will never make you late on handling any financial matters. Furthermore, they are there to make sure that the business does not lose money through inaccurate data entry which can jeopardize all the operations. From the previous recommendations, you can tell whether the potential accountant you want to hire is fast and accurate or not. If using a firm, then do an overall research on the firm before engaging any of their accountants.

is why one is advised not to part with any money that most people solicit in the name of consolidation fee. You are advised to avoid any lenders who insist on you paying an upfront fee to facilitate the loan consolidation process. In case you encounter such people, you should be warned that they are out to swindle you of your money. If you find yourself in such a situation, you are advised to conduct your business somewhere else.

is why one is advised not to part with any money that most people solicit in the name of consolidation fee. You are advised to avoid any lenders who insist on you paying an upfront fee to facilitate the loan consolidation process. In case you encounter such people, you should be warned that they are out to swindle you of your money. If you find yourself in such a situation, you are advised to conduct your business somewhere else. One major advantage and information that everyone who wishes to consolidate their loan should have is that it is possible for an individual to pay off a consolidated loan at any time without having to worry about incurring any extra repayment penalties.But in such instances, it is advisable that one repays the consolidated loan as soon as possible. This will help them avoid accumulating interest charges. It will also relieve you of the

One major advantage and information that everyone who wishes to consolidate their loan should have is that it is possible for an individual to pay off a consolidated loan at any time without having to worry about incurring any extra repayment penalties.But in such instances, it is advisable that one repays the consolidated loan as soon as possible. This will help them avoid accumulating interest charges. It will also relieve you of the

payments and the interest rates that you pay for your debts. The plans are very crucial as they can reduce or waive any penalties.

payments and the interest rates that you pay for your debts. The plans are very crucial as they can reduce or waive any penalties. One major advantage of engaging debt management companies is that they are typically non-profit making counseling agencies. They normally charge a fee that is relatively affordable to most individuals. One other thing is that the fee has a set cap of fees that they can charge in the various states.

One major advantage of engaging debt management companies is that they are typically non-profit making counseling agencies. They normally charge a fee that is relatively affordable to most individuals. One other thing is that the fee has a set cap of fees that they can charge in the various states.